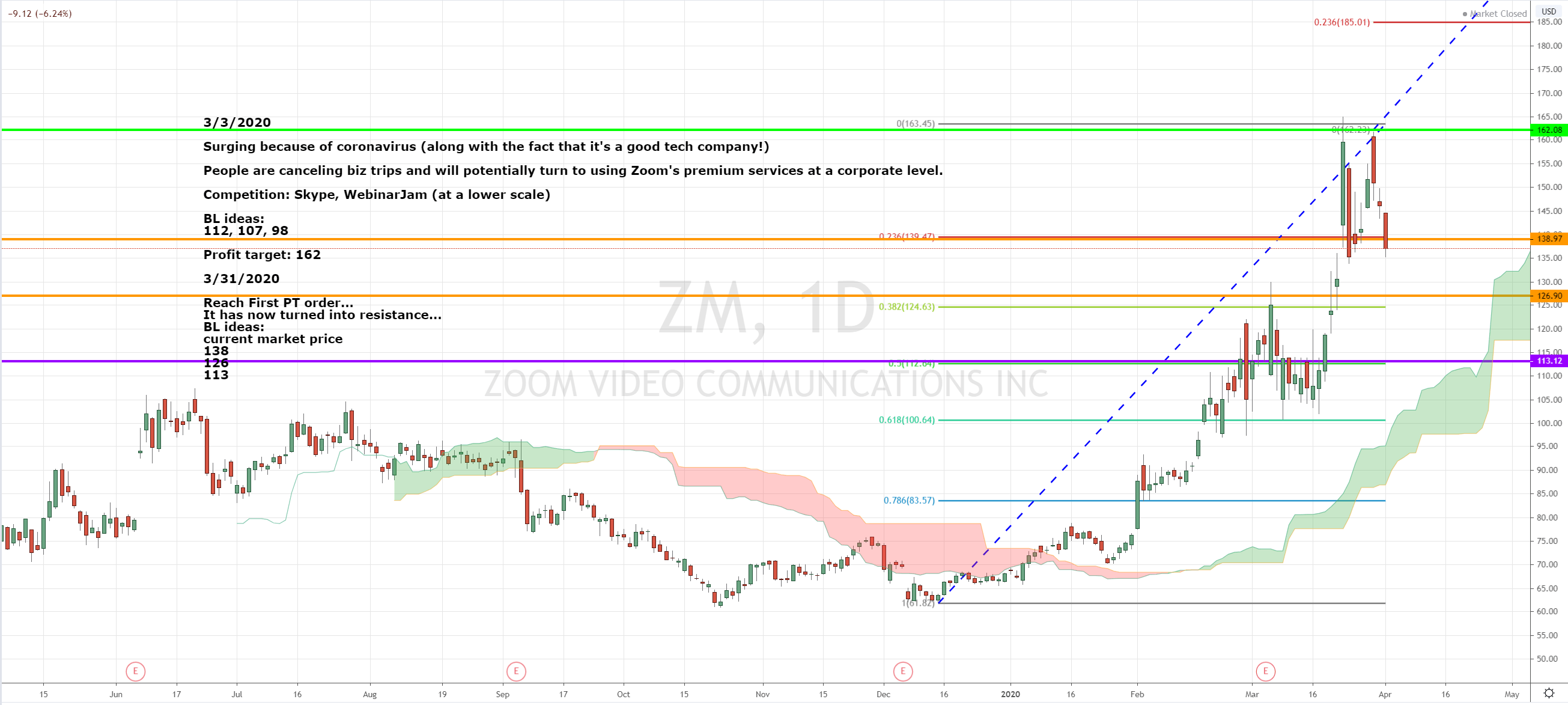

At its current price, the company is trading at around 18.5 times its forward sales.Ĭonsidering that Five9's revenues grew 44% last quarter, Zoom does not appear to be heavily overpaying in this deal. Hence, besides its own growth in the video conferencing space, Zoom should be able to unlock synergies and operational efficiencies with Five9's platform.įive9 features last-12-month revenues of $521.7 million. (See ZM stock charts on TipRanks)īolstering Growth Through Five9 (NASDAQ: FIVN)Įarlier in July, the company capitalized on its ongoing momentum by announcing a $14.7-billion all-stock agreement to acquire Five9 (FIVN). Net income grew 70.5% to $317 million, with net income margins expanding to around 31%.Įven if Zoom's revenue growth decelerates, it's quite likely that a margin expansion alone will keep satisfactory bottom-line growth levels due to how capital-light the company's business model is. In its latest quarterly results, Zoom reported year-over-year revenue growth of 54% to $1.02 billion.

Due to the company's fantastic scalability prospects, Zoom also enjoys jaw-dropping margins, which keep on expanding as its customer count grows. Zoom revenues quadrupled in 2020, as the work-from-home economy became the new norm. Its name has become synonymous with video conferencing over the past couple of years, as it has been one of the ultimate beneficiaries of the COVID-19 pandemic. Zoom Video Communications (NASDAQ: ZM) is a very interesting company. Zoom Video: Highly Profitable, but Competition Is Steep

0 kommentar(er)

0 kommentar(er)